- India

- Jul 03

Explainer - Project Nexus for cross-border retail payments

• The Reserve Bank of India (RBI) has joined ‘Project Nexus’, a multilateral international initiative to enable instant cross-border retail payments by interlinking domestic fast payments systems.

• An agreement was signed by the Bank for International Settlements (BIS) and the central banks of India, Malaysia, Philippines, Singapore, and Thailand on June 30, 2024, in Basel, Switzerland.

• Indonesia, which has been involved from the early stages, continues to be involved as a special observer.

• The RBI has been collaborating bilaterally with various countries to link India’s fast payments system — Unified Payments Interface (UPI), with their respective domestic fast payments systems for cross-border Person-to-Person (P2P) and Person-to-Merchant (P2M) payments.

• While India and its partner countries can continue to benefit through such bilateral connectivity of fast payment systems, a multilateral approach will provide further impetus to the efforts in expanding the international reach of Indian payment systems.

What is Project Nexus?

• It aims to enable instant cross-border payments by connecting multiple domestic instant payment systems globally.

• The project explores how to build on the success of domestic instant payments to improve the speed, cost, transparency and accessibility of cross-border payments.

• The project has produced a comprehensive blueprint for standardising the way that domestic instant payment systems connect, lowering the obstacles for countries that wish to offer instant cross-border payments.

• In over 70 countries today domestic payments reach their destination in seconds at near-zero cost to the sender or recipient. This is thanks to the growing availability of instant payment systems.

• Connecting these instant payment systems to each other can enable cross-border payments from sender to recipient within 60 seconds (in most cases).

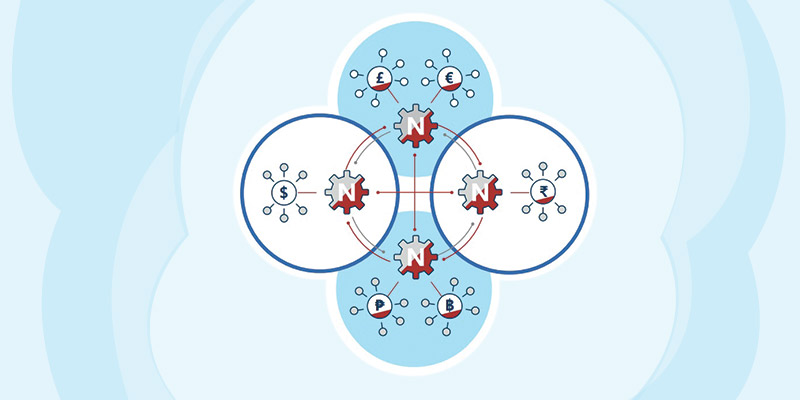

• Nexus is designed to standardise the way that instant payment systems connect to each other. Rather than a payment system operator building custom connections for every new country that it connects to, the operator can make one connection to the Nexus platform.

• This single connection allows a fast payments system to reach all other countries on the network. Nexus could significantly accelerate the growth of instant cross-border payments.

• This has been a collaborative effort between the BIS Innovation Hub (BISIH) and interested central banks and instant payment systems that has been developed and refined over three phases of work. In the next and final phase of Nexus, the BISIH will support a coalition of countries interested to implement Nexus.

• Phase four will see central banks of Malaysia, Philippines, Singapore, Thailand and domestic instant payment systems who worked together in phase three joined by the Reserve Bank of India, expanding the potential user base to India's Unified Payments Interface (UPI).

• The platform can be extended to more countries, going forward. The platform is expected to go live by 2026.

• The coalition of countries have agreed to work towards establishing a new entity, the Nexus Scheme Organisation (NSO), which will be responsible for managing the Nexus scheme and its rulebook.

• While the BIS will not own or operate the NSO, it will continue its support by playing an advisory role as participating countries work towards taking Nexus live.

Benefits of Nexus:

• Efficient cross-border transactions: Nexus reduces the complexity of cross-border payments by shortening the transaction chain, reducing overall cost and time for cross-border transactions.

• Cost-effective global solution: Participants would only incur a one-time integration cost to connect to Nexus, to access all participating countries. This minimises the time, effort and cost required for integration while maximising scalability as a global solution.

• A standardised and resilient ecosystem: All Nexus participants would adhere to a common Nexus Scheme Rulebook, ensuring consistency and harmonisation. Minimum standards are enforced, promoting proper risk management practices and ecosystem safety.

• Seamless integration with existing apps: Users can utilise existing apps of any participating Payment Service Providers (PSP) in order to make a Nexus transaction.

• Greater convenience via the use of proxies: Proxies, such as mobile phone numbers, can be used for Nexus transactions, eliminating the need for lengthy international bank account numbers.

• Transparent fee disclosure: Users will receive upfront details on all fees, foreign exchange rate and amount to be credited into the recipient’s account.

Manorama Yearbook app is now available on Google Play Store and iOS App Store