- India

- Nov 07

What is PM-Vidyalaxmi scheme?

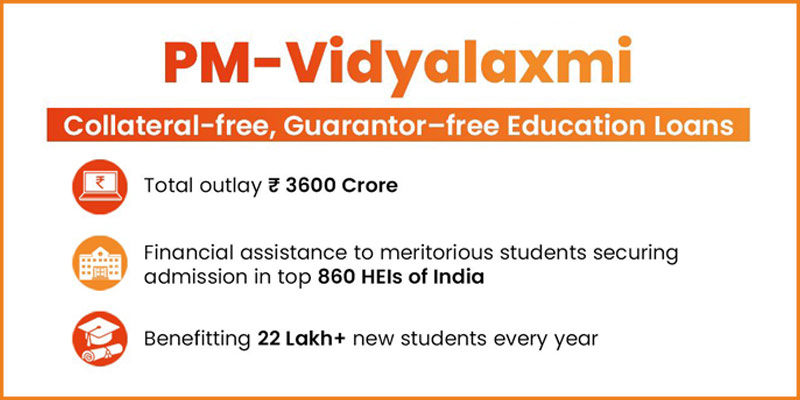

The Union Cabinet approved the PM-Vidyalaxmi scheme to provide monetary support to meritorious students for pursuing quality higher education.

Highlights of PM Vidyalaxmi scheme:

• PM Vidyalaxmi is another key initiative stemming out of the National Education Policy, 2020, which had recommended that financial assistance should be made available to meritorious students through various measures in both public and private Higher Education Institutions.

• It is a Central Sector scheme that seeks to provide financial support to meritorious students so that financial constraints do not prevent anyone from pursuing higher studies.

• As per the scheme, anybody who gets admission in Quality Higher Education Institutions (QHEIs) will be eligible to get collateral-free, guarantor-free loan from banks and financial institutions to cover the full amount of tuition fees and other expenses related to the course.

• An outlay of Rs 3,600 crore has been approved for the scheme under which education loans will be facilitated to students securing admissions in top 860 QHEIs of the country based on the National Institutional Ranking Framework (NIRF).

• This will cover more than 22 lakh students every year.

• The scheme will be applicable to the top QHEIs as determined by the NIRF rankings, including all HEIs, government and private, that are ranked within the top 100 in NIRF in overall, category-specific and domain-specific rankings, state government HEIs ranked in 101-200 in the NIRF and all central government-run institutions.

• This list will be updated every year using the latest NIRF ranking, and to begin with 860 qualifying QHEIs.

• For loan amount up to Rs 7.5 lakh, the student will also be eligible for a credit guarantee of 75 per cent of outstanding default.

• This will give support to banks in making education loans available to students under the scheme. In addition, students having an annual family income of up to Rs 8 lakh, and not eligible for benefits under any other government scholarship or interest subvention schemes, 3 per cent interest subvention for loan up to Rs 10 lakh will also be provided during moratorium period.

• The interest subvention support will be given to one lakh students every year.

• Preference will be given to students who are from government institutions and have opted for technical and professional courses.

• An outlay of Rs 3,600 crore has been made during 2024-25 to 2030-31, and 7 lakh fresh students are expected to get the benefit of this interest subvention during the period.

• The Department of Higher Education will have a unified portal, ‘PM-Vidyalaxmi’, in which students will be able to apply for the education loan as well as interest subvention, through a simplified application process to be used by all banks.

• Payment of interest subvention will be made through e-voucher and Central Bank Digital Currency (CBDC) wallets.

Manorama Yearbook app is now available on Google Play Store and iOS App Store