- India

- Sep 18

India climbs to 38th rank in the Global Innovation Index 2025

• India climbed one place to 38th rank out of 139 economies World Intellectual Property Organisation’s (WIPO) Global Innovation Index (GII) 2025 ranking. Last year, the country was ranked 39th.

• Switzerland remained the world’s innovation leader for a 15th consecutive year.

• Sweden and the USA retained their second and third positions for the third year in a row.

Global Innovation Index

• The Global Innovation Index 2025 (GII), in its 18th edition this year, is published by WIPO in partnership with the Portulans Institute.

• Since its inception in 2007, the GII has shaped the innovation measurement agenda and become a cornerstone of economic policymaking, with an increasing number of governments systematically analyzing their GII results and designing policy responses to improve performance.

• Published annually, the core of the GII provides performance metrics and ranks around 140 economies on their innovation ecosystems.

• The GII uses 78 indicators, ranging from research and development (R&D) spending, venture capital (VC) deals, high-tech exports and intellectual property filings in evaluating nearly 140 world economies on their innovative performance.

• It is the world’s benchmark resource for policymakers, business leaders and others in promoting innovation and building strong innovation ecosystems.

• The GII 2025 is calculated as the average of two sub-indices.

• The Innovation Input Sub-Index gauges elements of the economy that enable and facilitate innovative activities and is grouped into five pillars:

i) Institutions

ii) Human capital and research

iii) Infrastructure

iv) Market sophistication

v) Business sophistication.

• The Innovation Output Sub-Index captures the results of innovative activities via two pillars: Knowledge and technology outputs and Creative outputs.

Key points of the report:

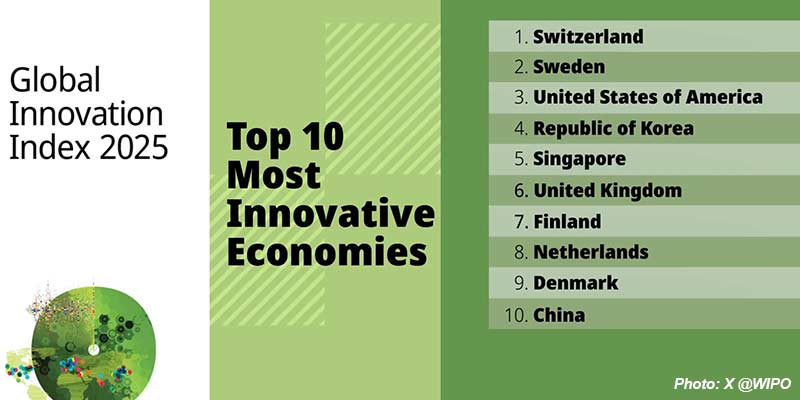

• Switzerland, Sweden, USA, South Korea and Singapore top the Index, followed by the United Kingdom, Finland, Netherlands, Denmark and China, which breaks into the top 10 for the first time.

• In GII 2025, as many as 17 low and middle-income economies are performing above expectations for their level of development, with India and Vietnam as longest-running innovation overperformers.

• R&D growth fell to 2.9 per cent in 2024, a slowdown from the 4.4 per cent increase in the year prior and the lowest growth since the financial crisis of 2010. Growth is projected by WIPO to slow further in 2025 (2.3 per cent).

• Corporate R&D spending in real terms slowed to 1 per cent due to persistently high inflation — far below the 4.6 per cent average of the past decade.

• ICT-related firms (particularly in AI-intensive sectors), software and pharma firms expanded R&D budgets, while manufacturing firms such as in the automotive sector and consumer goods cut R&D spend in a context of declining company revenues.

• International patent filings via WIPO rebounded (+0.5 per cent), with strong growth in South Korea (+7 per cent), but declined in the US, Japan and Germany.

• Technological progress — a dimension covered in the GII Global Innovation Tracker — remained strong. Battery prices and supercomputer efficiency improved, while the cost of genome sequencing declined further.

• Technology adoption advanced but slowed. Growth remained evident in robotics and connectivity. High-speed rail networks, a new indicator in 2025, expanded. In turn, robot and EV adoption experienced a marked slowdown.

• Socioeconomic indicators improved—labour productivity and life expectancy rose, poverty declined further.

India remains the top regional performer

• India continues to lead innovation within the Central and Southern Asia region, rising one spot to 38th place in 2025.

• It remains the top performing lower middle-income economy.

• Its strengths lie in its scale, entrepreneurial activity and a growing ability to translate scientific knowledge into commercial impact.

• India stands out for its ICT services exports, a vibrant venture capital landscape, late-stage venture capital and startup financing, unicorns and intangible assets, reflecting tech-driven growth.

• Yet, challenges remain. India continues to lag in Infrastructure and R&D spending – equal to only 0.65 per cent of its GDP in 2020, reflecting the need for further investment to be made.

• Innovation clusters — whether innovation-driven cities or regions — form the beating heart of national innovation systems. These hubs unite top universities, researchers, inventors, venture capitalists and R&D firms in driving forward breakthrough ideas.

• India has four clusters in the top 100: Bengaluru (21st), Delhi (26th), Mumbai (46th) and Chennai (84th), with most clusters boosted significantly by the inclusion of venture capital deal counts.