- India

- Nov 13

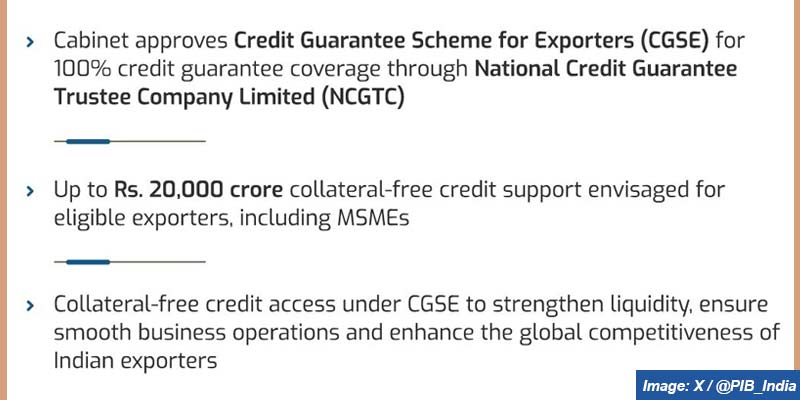

Cabinet approves Credit Guarantee Scheme for Exporters (CGSE)

• The Union Cabinet approved introduction of Credit Guarantee Scheme for Exporters (CGSE) for providing 100 per cent credit guarantee coverage by National Credit Guarantee Trustee Company Limited (NCGTC) to Member Lending Institutions (MLIs) for extending additional credit facilities up to Rs 20,000 crore to eligible exporters, including MSMEs.

• The scheme shall be implemented by the Department of Financial Services (DFS) through NCGTC to provide additional credit support by MLIs to the eligible exporters, including MSMEs.

• A management committee formed under the chairmanship of secretary, DFS, will oversee the progress and implementation of the scheme.

Significance of the scheme

• Exports are a critical pillar of the Indian economy, accounting for nearly 21 per cent of GDP in 2024-25 and contributing significantly to foreign exchange reserves.

• Export-oriented industries directly and indirectly employ over 45 million people with MSMEs contributing nearly 45 per cent of total exports.

• Sustained export growth has been instrumental in supporting India’s current account balance and macroeconomic stability.

• It is important to extend enhanced financial assistance and adequate time to exporters for diversifying their markets and enhance global competitiveness of Indian exporters.

• Accordingly, proactive government intervention to provide additional liquidity support will ensure business growth and also enable expansion of markets.

• CGSE is expected to enhance the global competitiveness of Indian exporters and support diversification into new and emerging markets.

• By enabling collateral-free credit access under CGSE, it will strengthen liquidity, ensure smooth business operations, and reinforce India’s progress towards achieving the $1-trillion export target.