- World

- Oct 22

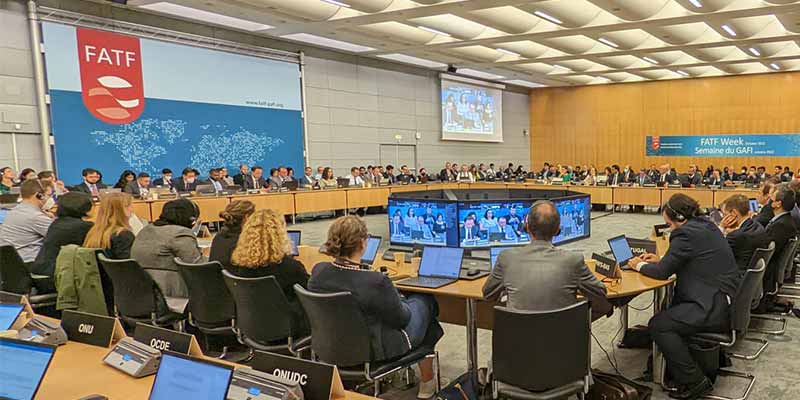

Explainer / What is FATF’s Black List and Grey List?

• After four years, Pakistan has been taken off from the ‘Grey List’ of FATF, the global watchdog on terror financing and money laundering.

• For the first time, the FATF put Myanmar in the “high risk jurisdictions subject to a call for action”, often referred to as the ‘Black List’. Iran and North Korea continue to be in the Black List.

• Democratic Republic of the Congo, Tanzania and Mozambique were added to the Grey List while Nicaragua was removed along with Pakistan.

• In other decisions, Russia was barred from participating in future projects of FATF.

What is the FATF?

• The FATF is an inter-governmental body established in 1989 by the ministers of its member jurisdictions.

• The objectives of the FATF are to set standards and promote effective implementation of legal, regulatory and operational measures for combating money laundering, terrorist financing and other related threats to the integrity of the international financial system.

• The FATF is a policymaking body that works to generate the necessary political will to bring about national legislative and regulatory reforms in these areas.

• The FATF currently has 39 members including two regional organisations — the European Commission and Gulf Cooperation Council.

• India is a member of the FATF consultations and its Asia Pacific Group.

The FATF has two types of lists:

1) High Risk Jurisdictions Subject to a Call for Action (Black List)

2) Jurisdictions under Increased Monitoring (Grey List).

1) Black List

• High-risk jurisdictions have significant strategic deficiencies in their regimes to counter money laundering, terrorist financing, and financing of proliferation.

• This list is referred to as the ‘Black List’.

• For all countries identified as high-risk, the FATF calls on all members and urges all jurisdictions to apply enhanced due diligence, and, in the most serious cases, countries are called upon to apply counter-measures to protect the international financial system from the money laundering, terrorist financing, and proliferation financing risks emanating from the country.

• Iran, North Korea and Myanmar are on the FATF Black List.

2) Grey List

• Countries that are considered as safe havens for supporting terror funding and money laundering are included in the ‘Grey List’.

• Jurisdictions under increased monitoring are actively working with the FATF to address strategic deficiencies in their regimes to counter money laundering, terrorist financing, and proliferation financing.

• When the FATF places a jurisdiction under increased monitoring, it means the country has committed to swiftly resolve the identified strategic deficiencies within agreed timeframes and is subject to increased monitoring.

• The FATF and FATF-style regional bodies (FSRBs) continue to work with the jurisdictions below as they report on the progress achieved in addressing their strategic deficiencies.

• The FATF calls on these jurisdictions to complete their action plans expeditiously and within the agreed timeframes.

• Inclusion in the Grey List makes it difficult for a country to get financial aid from world bodies such as the IMF. The list makes it difficult to get investors and creditors, adversely impacts exports, output and consumption and also makes it difficult for global banks to do business with a listed country.

Why Pakistan has been removed from the Grey List?

• Pakistan was on the Grey List of FATF since June 2018 for failing to check money laundering, leading to terror financing.

• The FATF said there has been significant progress on the part of Pakistan to combat financial terrorism and money laundering which resulted Pakistan being taken off from the increased monitoring mechanism or the Grey List.

• The FATF looked into the mechanism put in place by Pakistan to combat financial terrorism and money laundering. The team went down to Pakistan and found the high level political commitment of Pakistan not only act to combat financial terrorism and money laundering but ensuring reforms and strengthen the system.

• According to the FATF, Pakistan has strengthened the effectiveness of its AML (anti-money laundering) and CFT (combatting the financing of terrorism) regime and addressed technical deficiencies to meet the commitments of its action plans regarding strategic deficiencies that the FATF identified in June 2018 and June 2021, the latter of which was completed in advance of the deadlines, encompassing 34 action items in total.

• With Pakistan’s exit from the Grey List, the country can try to get financial aid from the International Monetary Fund (IMF), the World Bank, the Asian Development Bank (ADB) and the European Union (EU), to boost its cash-strapped economy.

Manorama Yearbook app is now available on Google Play Store and iOS App Store