- India

- Aug 21

Importance of financial literacy in India and the role of NSFE

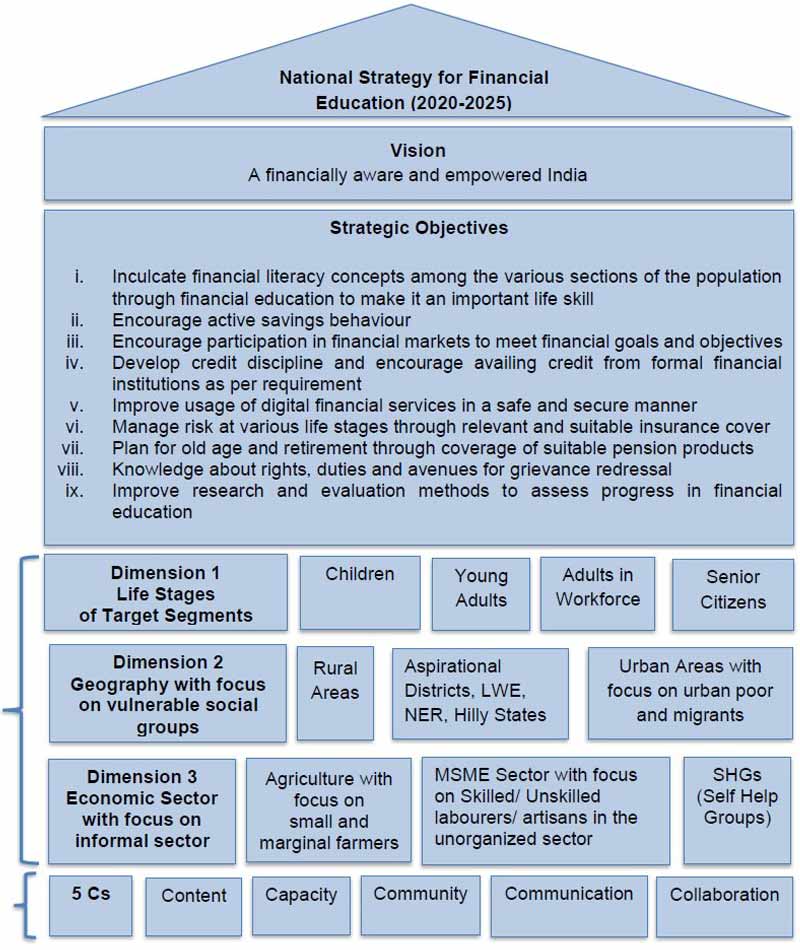

The Reserve Bank of India (RBI) released the ‘National Strategy for Financial Education 2020-2025’ (NSFE) and has suggested a multi-stakeholder-led approach for creating a financially aware and empowered India.

It has a ‘5-Core Actions’ approach for promoting financial education, which among other things include development of relevant content for school children and adults, community participation and collaboration among various stakeholders.

The importance of financial inclusion and financial literacy

Strengthening financial inclusion in the country has been one of the important developmental agendas of both the government of India and the four financial sector regulators — the RBI, Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority of India (IRDAI) and Pension Fund Regulatory and Development Authority (PFRDA). Financial inclusion is a national priority as it is an enabler for inclusive growth.

In the Indian context, financial inclusion is the process of ensuring access to appropriate financial products and services needed by vulnerable groups, such as weaker sections and low income groups, at an affordable cost in a fair and transparent manner by mainstream institutional players.

Financial inclusion provides an avenue to the poor for integrating with the formal financial system.

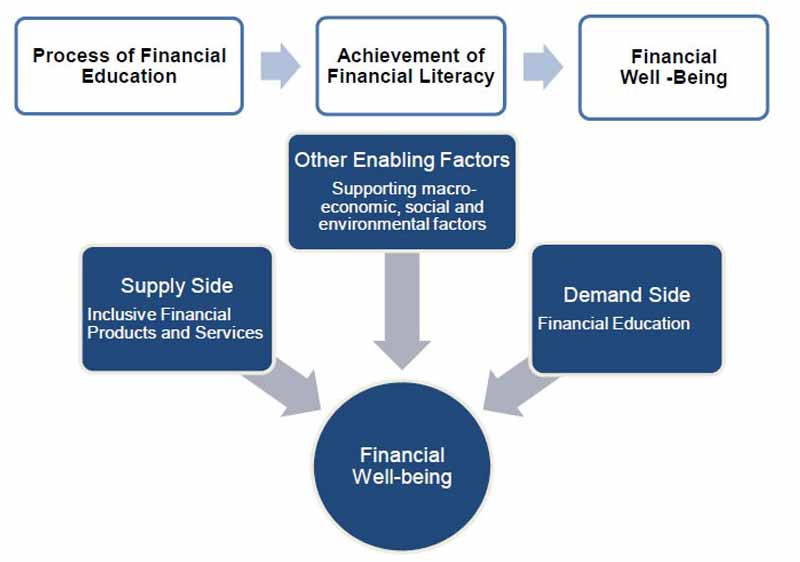

Financial literacy supports the pursuit of financial inclusion by empowering the customers to make informed choices leading to their financial well-being.

Financial literacy is defined as a combination of financial awareness, knowledge, skills, attitude and behaviour necessary to make sound financial decisions and ultimately achieve individual financial well-being.

Financial education, on the other hand is defined as the process by which financial consumers/investors improve their understanding of financial products, concepts and risks and through information, instruction and objective advice, develop the skills and confidence to become more aware of financial risks and opportunities, to make informed choices, to know where to go for help and to take other effective actions to improve their financial well-being.

The terms financial education and financial literacy are related concepts, but not the same. People achieve financial literacy through the process of financial education.

While financial inclusion is essentially a supply-side intervention, financial education is a demand side intervention. Apart from these forces operating on the demand side and supply side, there are also other enabling factors on the ground. Achievement of financial well-being of citizens of any country depends on how well these factors and forces are integrated and the extent to which these work in cohesion.

What is the purpose of NSFE?

The National Strategy for Financial Education (NSFE) is a nationally coordinated approach to financial education that consists of an adapted framework or programme.

Since a large number of stakeholders, including the central and state governments, financial sector regulators, financial institutions, civil society, academia, educational institutions in public and private sector and others are involved in spreading financial literacy, a broad NSFE is a prerequisite to ensure that they work in tandem and their work is aligned to the overall strategy on financial education.

What are the impacts of NSFE?

Since India’s first NSFE was released in 2013, there have been many developments in the financial inclusion scenario of the country.

During this period (2013-2018), important financial inclusion initiatives by government such as Pradhan Mantri Jan-Dhan Yojana (PMJDY), social security schemes — Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY), Pradhan Mantri Kisan Maan Dhan Yojana (PM-KMY), Pradhan Mantri Shram Yogi Mann Dhan Yojana (PM-SYM) and Pradhan Mantri Mudra Yojana (PMMY) have changed the financial inclusion landscape.

These initiatives are not only bringing the excluded sections into the financial mainstream but also ensuring access to various financial services such as Basic Savings Bank Deposit Account (BSBDA), need based credit, remittance facility, insurance and pension to the excluded sections.

The proportion of adults with a formal account in the country has risen from 35 per cent in 2011 to 80 per cent in 2017.

India has also made extraordinary progress in reducing the country’s gender gap in account ownership, from nearly 20 per cent in 2014 to 6 per cent in 2017.

The National Centre for Financial Education (NCFE) has been set up as a Section (8) company under Companies Act, 2013 to undertake basic financial education and to develop suitable content for increasing financial literacy among the masses in the country. NCFE prepares appropriate financial literature for target-based audiences on financial markets and financial digital modes for improving financial literacy so as to improve their knowledge, understanding, skills and competence in finance.

Vision and Strategic Objectives of NSFE (2020-2025)

As there have been several developments in the financial inclusion landscape and the economy, in general, the strategic objectives have been revised to reflect the changes in the vast economic landscape and provide renewed impetus to promote financial education in the vast expanse of the diverse country.

The strategic objectives are:

• Inculcate financial literacy concepts among the various sections of the population through financial education to make it an important life skill.

• Encourage active savings behaviour.

• Encourage participation in financial markets to meet financial goals and objectives.

• Develop credit discipline and encourage availing credit from formal financial institutions as per requirement.

• Improve usage of digital financial services in a safe and secure manner.

• Manage risk at various life stages through relevant and suitable insurance cover.

• Plan for old age and retirement through coverage of suitable pension products.

• Knowledge about rights, duties and avenues for grievance redressal

• Improve research and evaluation methods to assess progress in financial education.

A ‘5C’ approach would be adopted for dissemination of financial education through emphasis on development of relevant Content (including curriculum in schools, colleges and training establishments), developing Capacity among the intermediaries involved in providing financial services, leveraging on the positive effect of Community led model for financial literacy through appropriate Communication Strategy, and lastly, enhancing Collaboration among various stakeholders.

The Technical Group on Financial Inclusion and Financial Literacy (TGFIFL) would be responsible for periodic monitoring and implementation of the NSFE. There would also be periodic monitoring of the activities undertaken by various stakeholders for dissemination of basic, sector-specific, and process literacy.

Manorama Yearbook app is now available on Google Play Store and iOS App Store