- India

- Feb 16

Preeti Sinha to lead UN Capital Development Fund

• The UN Capital Development Fund has appointed Indian-origin investment and development banker Preeti Sinha as its executive secretary.

• Sinha succeeds Judith Karl, who retired in February after concluding her 30-year career in the United Nations.

What is the significance of UNCDF?

• The UN Capital Development Fund makes public and private finance work for the poor in the world’s 46 least developed countries (LDCs).

• It was established by the UN General Assembly on December 13, 1966 with the mandate to “assist developing countries in the development of their economies by supplementing existing sources of capital assistance by means of grants and loans”. The mandate was modified in 1973 to serve first and foremost but not exclusively the LDCs.

• UNCDF offers “last mile” finance models that unlock public and private resources, especially at the domestic level, to reduce poverty and support local economic development.

Its financing models work through three channels:

1) Inclusive digital economies, which connect individuals, households, and small businesses with financial ecosystems that catalyse participation in the local economy, and provide tools to climb out of poverty and manage financial lives.

2) Local development finance, which capacitates localities through fiscal decentralization, innovative municipal finance, and structured project finance to drive local economic expansion and sustainable development.

3) Investment finance, which provides catalytic financial structuring, de-risking, and capital deployment to drive SDG impact and domestic resource mobilization.

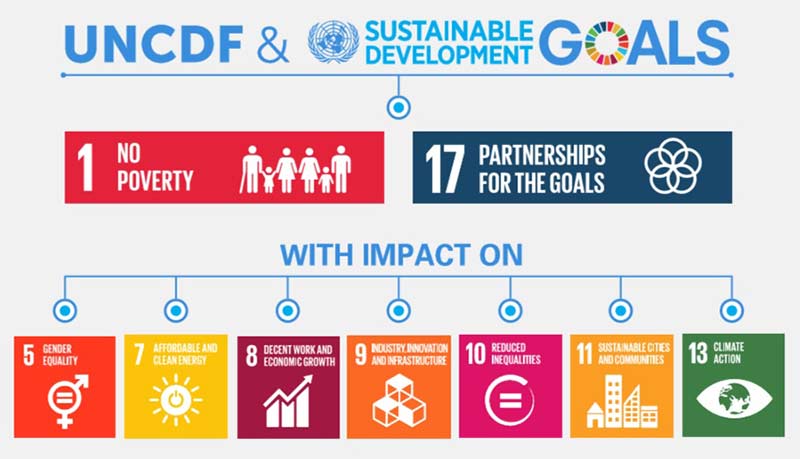

• By strengthening how finance works for poor people at the household, small enterprise, and local infrastructure levels, UNCDF contributes to SDG-1 on eradicating poverty, with a focus on reaching the last mile and addressing exclusion and inequalities of access.

• At the same time, UNCDF deploys its capital finance mandate in line with SDG-17 on the means of implementation, to unlock public and private finance for the poor at the local level.

• By identifying those market segments where innovative financing models can have transformational impact in helping to reach the last mile, UNCDF contributes to SDGs 5, 7, 8, 9, 10, 11, 13 and in total 28 of 169 targets.

• UNCDF is an autonomous, voluntarily funded UN organisation, affiliated with the United Nations Development Programme (UNDP). UNCDF raises its funding separately from UNDP. Its funding comes from UN member states, foundations and the private sector.

• UNCDF has its headquarters in New York and works worldwide out of three regional offices — Dakar, Addis Ababa and Bangkok — and is present in 39 countries through its programmes and offices, most of which are co-located with UNDP.

What will be the role of Preeti Sinha in UNCDF?

Sinha commenced her tenure as UNCDF executive secretary, the highest leadership rank in the institution, on February 15.

She will oversee the organisation’s efforts to deliver scalable impact in order to make the international financial architecture work for the world’s frontier and pre-frontier markets, with a specific emphasis on supporting sustainable development for women, youth, small and medium-sized enterprises, smallholder farmers, and other traditionally underserved communities.

Sinha will lead UNCDF’s work to harness the untapped growth potential of the LDCs, to enable and empower communities, local governments and small businesses to address the economic impacts of the COVID-19 pandemic while building more resilient and inclusive economies.

Sinha said her goal would be to make ‘C’ in UNCDF (capital) to be highly catalytic in mobilising manifold the public and private finance for the LDCs it serves and in developing a new era of engagement with capital markets in 2021 and onwards.

She has three decades of global experience across investment and development finance during which she managed institutional public and private development capital.

Sinha served as CEO and president of FFD Financing for Development LLC, a specialist development finance firm in Geneva, focusing on resource mobilisation, donor relations, innovative capital markets, partnerships, strategy, business development, and impact investment advisory to finance the UN Sustainable Development Goals (SDGs).

Previously, she managed the YES Global Institute, a practising private sector think-tank for socio-economic development in New Delhi, building the impact investment ecosystem in India. She also served in senior resource mobilisation roles at the African Development Bank, including managing its ADF-13 Replenishment, raising $7.3 billion from 27 donor countries. She has also led multicultural teams and worked in investment banking at HSBC, Rabobank, Lehman Brothers and JP Morgan in London, Hong Kong, Mumbai and New York.

Sinha graduated from the Harvard Kennedy School of Government Executive Education program in public financial management. She holds a Master’s in global leadership from the World Economic Forum and a Master’s in public and private management (MPPM)/MBA from the Yale School of Management. She is an alumnus of Dartmouth College, where she completed her Bachelor of Arts in economics and computer science.

Manorama Yearbook app is now available on Google Play Store and iOS App Store