- India

- Jun 29

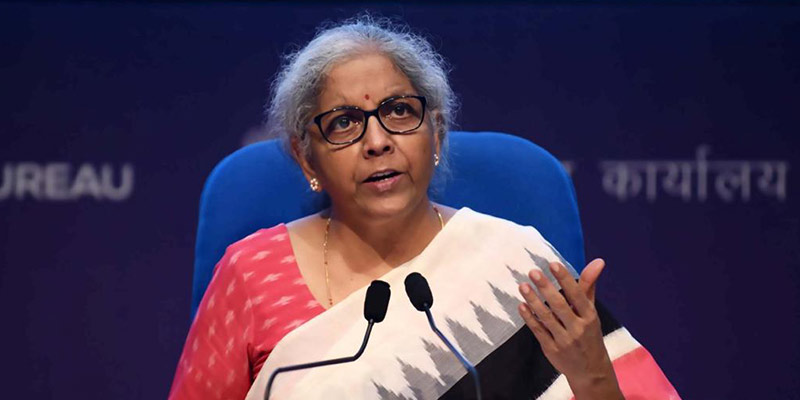

Sitharaman unveils Rs 6.28 lakh cr package to aid economic revival

To help revive the economy battered by COVID-19, Union Finance Minister Nirmala Sitharaman has announced a slew of measures including Rs 1.5 lakh crore of additional credit for small and medium businesses, more funds for the health care sector, loans to tourism agencies and guides, and waiver of visa fee for foreign tourists.

Together with previously announced Rs 93,869 crore spending on providing free foodgrains to the poor till November and additional Rs 14,775 crore fertiliser subsidy, the stimulus package — mostly made up of government guarantee to banks and microfinance institutions for loans they extend to COVID-hit sectors — totalled up to Rs 6,28,993 crore.

Details of the stimulus package:

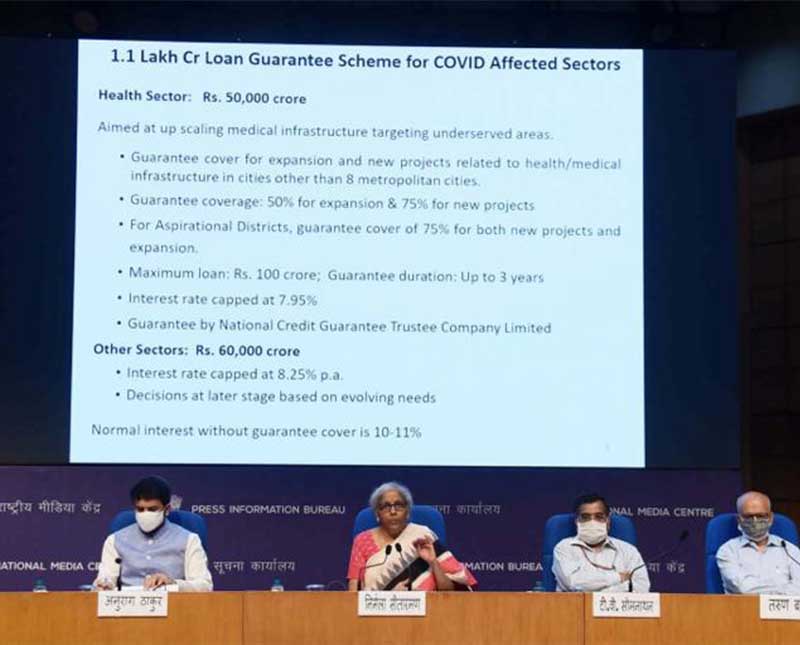

1.10 lakh crore loan guarantee scheme

• Under this new scheme, additional credit of Rs 1.10 lakh crore will flow to the businesses. This includes Rs 50,000 crore for the health sector and Rs 60,000 crore for other sectors, including tourism.

• The health sector component is aimed at upscaling medical infrastructure targeting underserved areas.

• Guarantee cover will be available both for expansion and new projects related to health/medical infrastructure in cities other than eight metropolitan cities.

• The guarantee cover will be 50 per cent for expansion and 75 per cent for new projects. In case of aspirational districts, the guarantee cover of 75 per cent will be available for both new projects and expansion.

• Guarantee will be provided through National Credit Guarantee Trustee Company Ltd (NCGTC).

• Maximum loan admissible under the scheme is Rs 100 crore and guarantee duration is up to three years.

• Banks can charge a maximum interest of 7.95 per cent on these loans. Loans for other sectors will be available with an interest cap of 8.25 per cent per annum. Thus, the loans available under the scheme will be much cheaper compared to the normal interest rates without guarantee of 10-11 per cent.

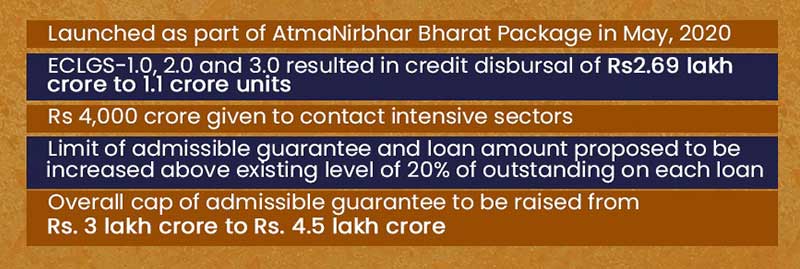

Emergency Credit Line Guarantee Scheme (ECLGS)

• The government has decided to expand the Emergency Credit Line Guarantee Scheme (ECLGS), launched as part of Atmanirbhar Bharat Abhiyan package in May 2020, by Rs 1.5 lakh crore.

• Banks and financial institutions have sanctioned Rs 2.73 lakh crore and disbursed Rs 2.10 lakh crore under the scheme

• Under the expanded scheme, the limit of admissible guarantee and loan amount is proposed to be increased above the existing level of 20 per cent of outstanding on each loan.

• Sector wise details will be finalised as per evolving needs.

• To support the micro, small & medium enterprises (MSME) sector, the overall cap of admissible guarantee has been raised from Rs 3 lakh crore to Rs 4.5 lakh crore.

Credit guarantee scheme for Micro Finance Institutions

• This is a new scheme and guarantee will be provided to Scheduled Commercial Banks for loans to new or existing NBFC-MFIs or MFIs for lending upto Rs 1.25 lakh to approximately 25 lakh small borrowers.

• Guarantee will be provided upto 75 per cent of default amount for upto 3 years through National Credit Guarantee Trustee Company (NCGTC). No guarantee fee to be charged by NCGTC under the scheme.

• The scheme focuses on new lending, and not on repayment of old loans.

• Loans from banks to be capped at MCLR plus 2 per cent.

• Maximum loan tenure will be three years, and 80 per cent of assistance to be used by MFI for incremental lending.

• Interest rates will be at least 2 per cent below the maximum rate prescribed by RBI.

• MFIs will lend to the borrowers in line with extant RBI guidelines such as number of lenders, borrower to be member of Joint Liability Group (JLG), ceiling on household income and debt.

• Another feature of the scheme is that all borrowers (including defaulters upto 89 days) will be eligible. Guarantee cover will be available for funding provided by MLIs to MFIs/NBFC-MFIs till March 31, 2022 or till guarantees for an amount of Rs 7,500 crore are issued, whichever is earlier.

Scheme for tourists guides/stakeholders

• The government will provide working capital or personal loans to people in the tourism sector to discharge liabilities or restart businesses impacted due to COVID-19.

• Loans will be provided with 100 per cent guarantee and with a limit of Rs 10 lakh for travel and tourism stakeholders and Rs 1 lakh for registered tourist guides.

• The scheme will cover 10,700 regional level tourist guides recognised by ministry of tourism and tourist guides recognised by state governments

• It will also cover about 1,000 travel and tourism stakeholders recognised by ministry of tourism.

• There will be no processing charges, waiver of foreclosure/prepayment charges and no requirement of additional collateral.

Free visas to 5 lakh tourists

• The government will provide free visas to five lakh tourists visiting India. This would incentivise short-term tourists visiting India.

• The total financial implication of this measure would be Rs 100 crore.

• The scheme would be applicable till March 31, 2022, or till 5 lakh visas are issued, whichever is earlier.

• As many as 10.93 million foreign tourists visited India in 2019 and spent $30.098 billion on leisure and business. Average daily stay for a foreign tourist in India is 21 days. Average daily spending of a tourist in India is around $34 (Rs 2400).

Extension of Atmanirbhar Bharat Rojgar Yojana (ABRY)

• Atmanirbhar Bharat Rojgar Yojana (ABRY) was launched on October 1, 2020

encouraging businesses to do fresh hiring amid the pandemic.

• The approved outlay under the scheme, which is aimed at incentivising employers for creation of new employment, restoration of loss of employment through EPFO, is Rs 22,810 crore for 58.50 lakh estimated beneficiaries.

• Around 21.42 lakh people have benefited from the scheme till June 18, 2021, with a total outgo of Rs 902 crore. The beneficiaries are spread around 79,577 establishments.

• The scheme is being implemented through the Employees Provident Fund Organisation (EPFO) and reduces the financial burden of the employers of various sectors/ industries and encourages them to hire more workers.

• The government has now extended the scheme till March 31, 2022.

• Under the scheme, the government is crediting for a period of two years both the employees’ share (12 per cent of wages) and employers’ share (12 per cent of wages) of contribution payable for establishment strength up to 1,000 employees and giving a salary of up to Rs 15,000 a month.

• In case of establishment strength of more than 1,000 for all those with Rs 15,000 per month salary, only employees’ share (12 per cent of wages) is credited by the government to the EPFO.

Additional subsidy for DAP & P&K fertilizers

• Additional subsidy to farmers for Diammonium Phosphate (DAP) and Phosphatic and Potassic (P&K) fertilizers was announced recently.

• Existing Nutrient Based Subsidy (NBS) was Rs 27,500 crore in FY 2020-21 which has been increased to Rs 42,275 crore in FY 2021-22.

• The farmers will benefit by an additional amount of Rs 14,775 crore. This includes Rs 9,125 crore additional subsidy for DAP and Rs 5,650 crore additional subsidy for nitrogen, phosphorus and potassium (NPK) based complex fertilizer.

Reintroduction of Pradhan Mantri Garib Kalyan Anna Yojana

• The Centre had launched the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) to provide free foodgrains to over 80 crore beneficiaries covered under the National Food Security Act (NFSA), as part of its effort to reduce the hardships of people during the pandemic.

• The scheme was operational during April-November in 2020.

• The Centre spent Rs 1,33,972 crore last fiscal on this scheme.

• After the outbreak of the second wave in April 2021, the PMGKAY scheme was reintroduced, initially for May-June and then extended till November this year.

• The Centre will spend Rs 93,869 crore this year to provide 5 kg of foodgrains per month free of cost to over 80 crore people during May-November for providing relief to poor.

• The total financial implication for PMGKAY is estimated at Rs 2,27,841 crore.

Additional funds for facilities in hospitals

• The government announced additional funding of Rs 23,220 crore for setting up paediatric beds and facilities in hospitals.

Under the scheme funds will be available for:

• Short-term HR augmentation through medical students (interns, residents, final year) and nursing students.

• Increasing availability of ICU beds.

• Oxygen supply at central, district and sub-district level.

• Availability of equipment, medicines.

• Access to tele-consultation.

• Strengthening ambulance services.

• Enhancing testing capacity and supportive diagnostics.

• Strengthen capacity for surveillance and genome sequencing.

ICAR will release 21 biofortified crop varieties

• To improve farmers’ income and fight malnutrition, the Indian Council of Agricultural Research (ICAR) has developed biofortified crop varieties having nutrients like protein, iron, zinc and vitamin A.

• These varieties are tolerant to diseases, insects, pests, drought, salinity, and flooding, early maturing and amenable to mechanical harvesting also developed. 21 such varieties of rice, peas, millet, maize, soyabean, quinoa, buckwheat, winged bean, pigeon pea and sorghum will be dedicated to the nation.

• Biofortification is the process by which the nutritional quality of food crops is improved through agronomic practices, conventional plant breeding, or modern biotechnology.

• Biofortification differs from conventional fortification. Biofortification aims to increase nutrient levels in crops during plant growth rather than through manual means during processing of the crops.

Revival of NERAMAC

• The government announced a Rs 77.45 crore revival package for the North Eastern Regional Agricultural Marketing Corporation (NERAMAC), so that farmers of the region get better prices for their produce.

• The Corporation was set up in 1982 to support farmers in the northeast in getting remunerative prices for agri-horticulture produces.

• It aims to enhance agricultural, procurement, processing and marketing infrastructure in the region. A total of 75 Farmer Producer Organisations / Farmer Producer Companies are registered with NERAMAC.

• It has facilitated registration of 13 Geographical Indicator (GI) crops of northeast.

• The company has prepared a business plan to give 10-15 per cent higher price to farmers by-passing middlemen/agents.

• It also proposes to set up North-Eastern Centre for Organic Cultivation, facilitating equity finance to entrepreneurs.

Boost for project exports through NEIA

• The government has decided to extend support to the National Export Insurance Account (NEIA) Trust, which shall now underwrite an additional Rs 33,000 crore for project exports over the next five years through the Exim Bank of India.

• NEIA Trust has supported 211 projects worth Rs 52,860 crore in 52 countries by 63 different Indian project exporters till March 31, 2021.

• NEIA Trust promotes Medium and Long Term (MLT) project exports by extending risk covers and provides covers to buyer’s credit, given by EXIM Bank, to less creditworthy borrowers and supporting project exporters.

Rs 88,000 crore boost to export insurance cover

• The government will infuse funds into Export Credit Guarantee Corporation (ECGC) over a five-year period to boost merchandise export insurance cover by Rs 88,000 crore.

• ECGC promotes exports by providing credit insurance services. Its products support around 30 per cent of India’s merchandise exports.

Additional funds for BharatNet project

• The government allocated an additional Rs 19,041 crore to provide broadband connectivity in all villages under the BharatNet project. With this, the total outlay for BharatNet project goes up to Rs 61,109 crore.

• PM Narendra Modi had on August 15, 2020 announced that all villages will be connected with broadband in 1,000 days.

• Under the BharatNet project, the government initially targeted to cover all 2.50 lakh gram panchayats with high-speed broadband services.

• About Rs 42,068 crore has been already utilised for reaching 1,56,223 gram panchayats that are now ready for broadband services as of May 31.

Extension of tenure of PLI scheme for large scale electronics manufacturing

• The government extended the period of production-linked incentive (PLI) scheme for large-scale electronics manufacturing with a focus on mobile phones by a year until 2025-26.

• The base year of the scheme 2019-20 remains the same but the companies will have the option to choose their five-year period either from the base year or the year 2020-21 for calculation of the incentives under the scheme.

• The PLI scheme provides 4-6 per cent incentives on incremental sales of goods under target segments that are manufactured in India, for a period of five years.

Centre’s share in reforms-based result-linked power distribution scheme

• Revamped reforms-based result-linked power distribution scheme of financial assistance to electricity distribution companies (discoms) for infrastructure creation, upgradation of system, capacity building and process improvement was announced in the Union Budget of 2021-22.

• Total outlay for the scheme is Rs 3,03,058 crore, out of which the central government’s share will be Rs. 97,631 crore.

• It aims at state specific intervention in place of “one size fits all”. Participation in the scheme is contingent on pre-qualification criteria like publication of audited financial reports, upfront liquidation of state government’s dues/subsidy to discoms and non-creation of additional regulatory assets.

• Under the scheme, assistance will be provided for installation of 25 crore smart meters, 10,000 feeders, 4 lakh km of LT overhead lines.

• Ongoing works of Integrated Power Development Scheme (IPDS), Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY) and Pradhan Mantri Sahaj Bijli Har Ghar Yojana (Saubhagya) will also be merged in the scheme.

• The amount available under the scheme is in addition to the allowed additional borrowing of 0.5 per cent of Gross State Domestic Product which will be available to the states annually for the next four years subject to carrying out specified power sector reforms.

New streamlined process for PPP projects

• New streamlined approval process for public private partnership (PPP) projects and monetisation of core infra assets will be formulated, which will help fast-track asset monetisation by CPSEs.

• The new policy for appraisal and approval of PPP proposals and monetisation of core infrastructure assets, including through Infrastructure Investment Trusts (InvITs), is aimed at ensuring speedy clearance of projects to facilitate private sector's efficiencies in financing construction and management of infrastructure.

Manorama Yearbook app is now available on Google Play Store and iOS App Store