- India

- Aug 28

Explainer / Pradhan Mantri Jan Dhan Yojana

The government’s flagship financial inclusion scheme Pradhan Mantri Jan Dhan Yojna (PMJDY) completed seven years after its launch in 2014.

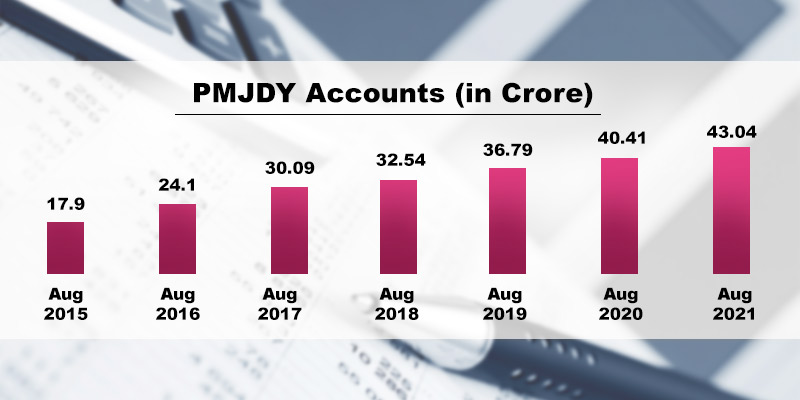

As on August 18, 2021, the number of total PMJDY accounts stood at 43.04 crore. Of this, 55.47 per cent (23.87 crore) Jan Dhan account holders are women and 66.69 per cent (28.70 crore) holders are in rural and semi-urban areas.

Pradhan Mantri Jan Dhan Yojana (PMJDY)

• The PMJDY was announced by PM Narendra Modi in his Independence Day address on August 15, 2014 and was launched on August 28.

• It was launched as a national mission on financial inclusion to ensure comprehensive financial inclusion of all the households in the country by providing universal access to banking facilities with at least one basic bank account to every household, financial literacy, access to credit, insurance and pension facility.

Benefits under PMJDY:

• One basic savings bank account is opened for unbanked person.

• There is no requirement to maintain any minimum balance in PMJDY accounts.

• Interest is earned on the deposit in PMJDY accounts.

• Rupay Debit card is provided to the PMJDY account holder.

• Accident insurance cover of Rs 1 lakh (enhanced to Rs 2 lakh to PMJDY accounts opened after August 28, 2018) is available with RuPay card issued to the PMJDY account holders.

• An overdraft (OD) facility up to Rs 10,000 to eligible account holders.

• PMJDY accounts are eligible for Direct Benefit Transfer (DBT).

Major achievements:

• During the first year of the scheme, 17.90 crore PMJDY accounts were opened.

• Out of total 43.04 crore PMJDY accounts, 36.86 crore or 85.6 per cent are operative, and the average deposit per account is Rs 3,398.

• Increase in average deposit is another indication of increased usage of accounts and inculcation of saving habit among account holders.

• Total RuPay cards issued to PMJDY account holders rose to 31.23 crore. For accounts opened after August 28, 2018, the free accidental insurance cover on RuPay cards increased from Rs 1 lakh to Rs 2 lakh.

• Under the PM Garib Kalyan Yojana announced on March 26, 2020, an amount of Rs 500 per month for three months (April 2020 to June 2020) was credited to the accounts of PMJDY women account holders. A total of Rs 30,945 crore has been credited in accounts of women PMJDY account holders during Covid lockdown as an income support measure.

• About five crore PMJDY account holders receive direct benefit transfer (DBT) from the government under various schemes.

• To ensure that the eligible beneficiaries receive their DBT in time, the government takes an active role in identification of avoidable reasons for DBT failures in consultation with DBT Mission, NPCI, banks and various other ministries.

• A mobile application — Jan Dhan Darshak — was launched in 2018 to provide a citizen centric platform for locating banking touchpoints such as bank branches, ATMs, Bank Mitras, post offices, etc in the country. Over eight lakh banking touchpoints have been mapped on the app.

How does PMJDY help in financial inclusion?

• Census 2011 estimated that out of 24.67 crore households in the country, only 14.48 crore (58.7 per cent) had access to banking services. In the first phase of the scheme, these households were targeted for inclusion through opening of a bank account within a year of launch of the scheme.

• Financial inclusion is a national priority of the government as it is an enabler for inclusive growth. It provides an avenue to the poor for bringing their savings into the formal financial system, an avenue to remit money to their families in villages besides taking them out of the clutches of the usurious money lenders.

• Jan Dhan Yojna is one of the biggest financial inclusion initiatives in the world.

• Under this scheme, a person not having a savings account can open an account without the requirement of any minimum balance. It offers basic savings bank accounts with an overdraft facility of Rs 10,000 to every account holder.

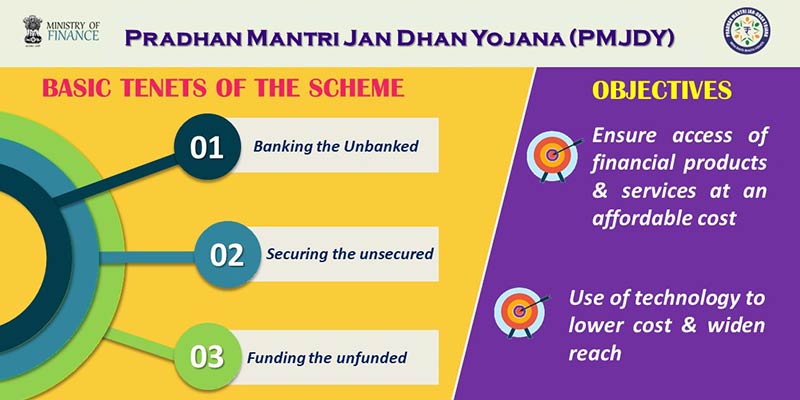

• PMJDY aims to provide universal banking services for every unbanked household, based on the guiding principles of banking the unbanked, securing the unsecured, funding the unfunded and serving the unserved and underserved areas.

Banking the unbanked: Opening of basic savings bank deposit account with minimal paperwork, relaxed KYC, e-KYC, account opening in camp mode, zero balance and zero charge.

Securing the unsecured: Issuance of indigenous debit cards for cash withdrawals and payments at merchant locations, with free accident insurance coverage of Rs 2 lakh.

Funding the unfunded: Other financial products like micro-insurance, overdraft for consumption, micro-pension & micro-credit.

• Whether it is direct benefit transfers, COVID-19 financial assistance, PM-KISAN, increased wages under MGNREGA, life and health insurance cover, the first step was to provide every adult with a bank account, which PMJDY has nearly completed.

• A majority of the beneficiaries are women and most of the accounts are from rural India.

The road ahead

• Eligible PMJDY account holders will be sought to be covered under the Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY).

• The government is also focused on promotion of digital payments including RuPay debit card usage amongst PMJDY account holders through creation of acceptance infrastructure across India.

• Another focus area is improving access of PMJDY account holders to micro-credit and micro investment such as flexi-recurring deposit, etc.

Additional read:

The importance of financial inclusion and financial literacy

Strengthening financial inclusion in the country has been one of the important developmental agendas of both the government of India and the four financial sector regulators. Financial inclusion is a national priority as it is an enabler for inclusive growth.

Manorama Yearbook app is now available on Google Play Store and iOS App Store