- India

- Nov 08

Explainer / What are InvITs?

Under the National Monetisation Pipeline (NMP), the National Highways Authority of India (NHAI) has launched its Infrastructure Investment Trust (NHAI InvIT) to monetise National Highway projects.

Infrastructure Investment Trusts (InvITs) are instruments on the pattern of mutual funds, designed to pool money from investors and invest the amount in assets that will provide cash flows over a period of time.

NHAI has the largest share under the National Monetisation Pipeline as road assets worth Rs 1.60 lakh crore will be monetised over four years till FY25 under the NMP plan announced by Finance Minister Nirmala Sitharaman in August this year.

Union Minister Nitin Gadkari said that NHAI InvIT attracted two international pension funds — Canadian Pension Plan Investment Board and Ontario Teachers’ Pension Plan Board — which along with diversified domestic institutional investors (DIIs) have invested units worth more than Rs 5,000 crore in InvIT portfolio which currently has five National Highways.

What is Infrastructure Investment Trust (InvIT)?

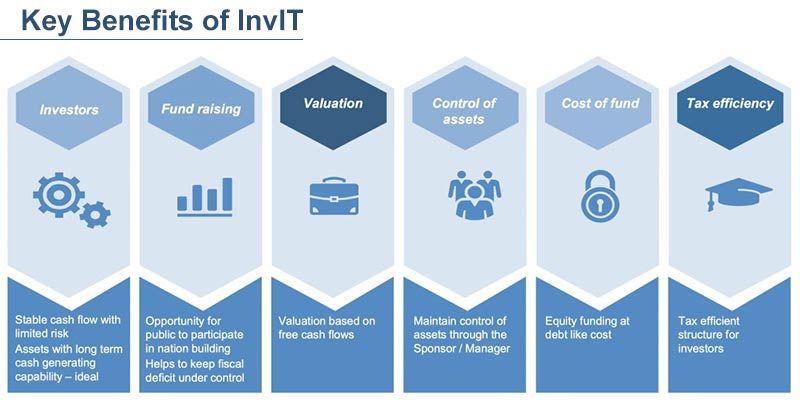

• Infrastructure Investment Trust (InvIT) is an innovative trust-based financial instrument, which enables participation in infrastructure financing through a stable and liquid instrument.

• InvITs provide an opportunity to invest in infrastructure assets with predictable cash flows and dividends.

• InvITs have been introduced in India in 2014 and are employed by infrastructure asset owners to pool in money from a diverse set of investors against pay-out of cash flow generated by the assets on a periodic basis.

• InvITs are established are trusts under the Indian Trust Act, 1882 and regulated under the SEBI (Infrastructure Investment Trusts) Regulations, 2014.

InvIT transactions in India

• India has seen a number of InvIT transactions over the last 4-5 years.

• According to a government report, the total Assets Under Management (AUM) across eight active InvITs is around Rs 1.4 lakh crore. Bulk of the assets are under toll roads (Rs 47,500 crore), followed by telecom (Rs 42,000 crore), gas pipeline (Rs 16,500 crore) and power transmission (Rs 14,000 crore).

• Since the introduction of InvIT regulations, bulk of the InvITs have been sponsored by private sector infrastructure developers.

• The first InvIT of a public sector entity, PowerGrid has been recently launched in the market. The issue has monetised assets worth Rs 7,800 crore and Powergrid has divested 85 per cent of its unit holding in the InvIT.

InvITs – Similar instruments globally

Globally private institutional funds have complemented debt funds in financing infrastructure investment. There has been a global consensus on the potential for tapping large institutional investors (including pension funds, sovereign wealth funds, etc) as well as retail investors towards infrastructure asset class, especially with lower risk levels (brownfield assets).

Two specific instruments seen in the US which have been fairly successful in tapping institutional investors into infrastructure assets are Yieldcos and Master Limited Partnerships (MLPs).

How does it work?

• Under an InvIT transaction, infrastructure asset owners transfer multiple revenue generating asset special purpose vehicles (SPVs) through holding company (holdco) or otherwise to a trust which then issues units to investors for raising money.

• The upfront money so raised is utilised by the developers for creation of new greenfield assets as also for repayment of debt which enables availability of capital with lenders for investment/lending to new projects.

• The investors, in lieu of invested money, receive a share of Net Distributable Cash Flows (NDCF – similar to the dividend pay-outs) on a periodic basis, commensurate with their unit holding in the Trust.

• Improved yields for the unit holders can be insured, by adding revenue-generating projects and expanding its portfolio.

Key stakeholders

Under this structure, the public asset owner (sponsor) creates an independent trust and transfers the ownership/ rights of the public assets to the same. Investors (unit holders) are the beneficiaries of the trust.

The sponsor: The sponsor is the public asset owner (for public-owned assets) which sets up the InvIT with the objective to monetise its assets. In case of PPP projects, the sponsor is the infrastructure developer or a SPV holding the concession agreement.

The trustee: The trustee means a person who holds the InvIT assets in trust for the benefit of the unit holders, in accordance with extant regulations.

The unit holders: The unit holders are the investors who subscribe to the units of the InvIT. The unit holders are the eventual beneficiaries of the asset.

The investment manager: The investment manager is responsible for taking investment decisions in the interest of unit holders including addition of new assets / sale of existing assets, leverage, etc.

The project manager: The project manager brings in the operational expertise of managing the infrastructure assets as per the interest of the unit holders.

Other key stakeholders incidental to the InvIT registration and issuance process include valuer, auditors, merchant bankers, registrar & transfer agent, banks, registrar to the issue, credit rating agencies and depository participants.

Key points on NHAI InvIT:

• NHAI in April had filed draft papers with markets regulator Securities and Exchange Board of India (SEBI) for floating an Infrastructure Investment Trust (InVIT) through which it had sought to raise Rs 5,100 crore.

• NHAI InvIT attracted two international pension funds — Canada Pension Plan Investment Board and Ontario Teachers’ Pension Plan Board — as anchor investors and they will hold 25 per cent of the units each.

• The balance units were placed with a diversified set of domestic institutional investors (DIIs) comprising pension funds, insurance companies, mutual funds, banks and financial institutions.

• The InvIT will initially have a portfolio of five operating toll roads with an aggregate length of 390 kilometres, with more roads planned to be added later.

• These roads are located across the states of Gujarat, Karnataka, Rajasthan and Telangana. NHAI has granted new concessions of 30-years for these roads.

• The total enterprise value of the initial portfolio of five roads was pegged at Rs 8,011.52 crore.

• NHAI InvIT is funding that through debt of Rs 2,000 crore from State Bank of India, Axis Bank and Bank of Maharashtra. The balance is being funded by issuing units of Rs 6011.52 crore to international and domestic institutional investors, and NHAI as a sponsor.

• Because of the long-term nature of the assets, the units of InvIT were placed with international and domestic institutional investors.

• The units have been issued under the private placement route under SEBI InvIT Regulations, 2014 at the upper valuation band of Rs 101 per unit.

• InvIT as an instrument provides greater flexibility to investors and is expected to attract patient capital (for say 20-30 years) to the Indian highway market, as these investors are averse to construction risk and are interested in investment in assets that provide long-term stable returns.

Manorama Yearbook app is now available on Google Play Store and iOS App Store