- India

- Jan 31

- Sreesha V.M

India climbs global ladder in innovation and R&D

The Economic Survey 2025-26 said that India’s research and innovation ecosystem has, over the years, strengthened significantly.

Points that were highlighted:

• The country’s standing in scientific research output has risen sharply from the seventh position in 2010 to the third position globally currently in terms of scholarly publications, reflecting a sustained expansion of academic research capacity.

• The number of Indian universities in the 2026 Quacquarelli Symonds (QS) World University Rankings saw a five-fold jump, from 11 institutions in 2015 to 54 in 2026, making India the fourth most-represented country in the rankings.

• This places India at the top of the rankings within the lower middle-income country group and first in the Central and Southern Asia region.

• Bengaluru, New Delhi and Mumbai feature among the top 50 most innovation-intensive clusters in the world.

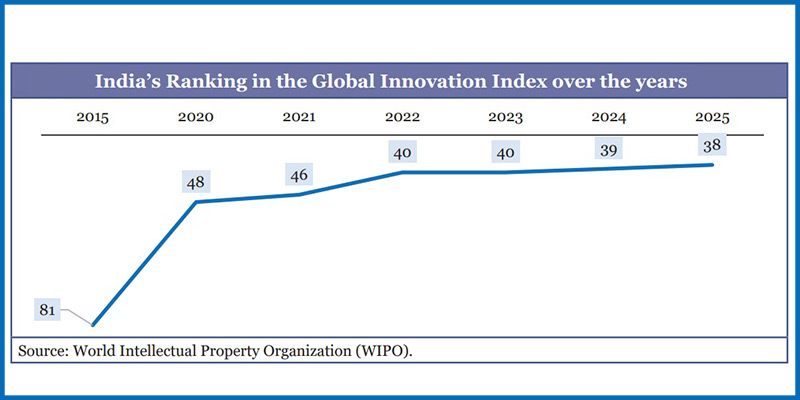

• The country’s innovation output as a whole, has recorded a marked growth.

• Emerging as a significant global player in Intellectual Property (IP), India ranks fourth in trademarks, sixth in patents, and seventh in industrial designs in global filings in 2024.

• From FY20 to FY25, patent applications filed nearly doubled, and trademark registrations grew 1.5 times.

• Designs registered increased by 2.5 times.

• The increased diffusion of design registrations alongside patent activity suggests a critical shift towards differentiated products, process innovation, and branding, marking an economy moving up the value chain.

• Marking a shift from the trends of a few years ago, where public-sector drove innovation, R&D now is also being driven by a vibrant startup ecosystem in the country.

• The World Intellectual Property Organisation (WIPO) ranks India 12th globally, for its entrepreneurship policies and entrepreneurship culture.

• As an evidence to this, since the launch of the Startup India Initiative in 2016, the number of DPIIT-recognised startups has increased from approximately 500 to over two lakh as of 2025.

• Flagship financing instruments, such as the Fund of Funds for Startups, the Startup India Seed Fund Scheme, and the Credit Guarantee Scheme for Startups, create an ecosystem that enables entrepreneurs to take risks and innovate with confidence.

• Innovation activity is increasingly broad-based, spanning biotech, Artificial Intelligence (AI), digital services, and sustainability-oriented solutions, supported by a growing pipeline of risk capital, credit access, and incubator-led early-stage support.

• Collectively, these indicators signal a system that is expanding in scale, quality, and sophistication, with innovation activity graduating from niche research entities into a wider industrial base.

• India is also establishing itself as a strong contender in critical technologies.

The Critical Technology Tracker, published by the Australian Strategic Policy Institute (ASPI), shows India now ranks among the top five countries in 45 out of 64 critical technologies, compared to just four technologies in the period from 2003 to 2007.

• This breadth across defence, space, quantum computing, AI, and advanced materials signals an expanding strategic capability essential for self-reliance.

Low expenditure in R&D remains a challenge

• Despite notable progress in research and development, challenges remain, primarily concerning R&D expenditure intensity.

• India’s Gross Expenditure on R&D (GERD) as a percentage of GDP stands at a modest 0.64 per cent, substantially below the global average.

• Leading economies, such as the US (3.48 per cent), China (2.43 per cent), and South Korea (4.91 per cent), invest significantly more.

• Low expenditure in R&D is partly due to low investment in R&D from the business sector, which accounts for only 41 per cent of the total expenditure.

• This is in stark contrast to countries such as China (77 per cent), United States (75 per cent), and South Korea (79 per cent), where business sector contributions to R&D are significantly higher.

• Bridging this disparity through various measures and fostering a conducive environment for private industry is critical for accelerating technological development.

Govt initiatives and funds to boost R&D

• A major institutional reform driving India’s R&D and aimed at addressing the challenges highlighted above is the establishment of the Anusandhan National Research Foundation (ANRF) under the ANRF Act, 2023.

• The ANRF is intended to provide strategic direction, competitive funding opportunities and collaboration pathways across industry, academia and government.

• The initiatives taken up by ANRF are being complemented by a suite of mission-driven national programmes such as the National Quantum Mission, the National Mission on Interdisciplinary Cyber-Physical Systems, the IndiaAI Mission, the India Semiconductor Mission, and the National Green Hydrogen Mission.

• Each initiative focuses on building foundational scientific capability in sunrise domains, translating research into scalable industrial capacity.

• To finance innovation at scale, the government also announced a new Research, Development and Innovation (RDI) Fund with a total outlay of Rs 1 lakh crore over six years and Rs 20,000 crore allocated for FY26.

• The Fund is designed to catalyse private investment in high-tech R&D, support projects at advanced technological readiness levels, enable acquisition of strategically important technologies, and operationalise a Deep-Tech Fund of Funds.

• Together, the ANRF, the national missions and the RDI Fund form a consolidated architecture for expanding India’s GERD beyond its current level and accelerating India’s transition towards technological leadership and the broader objectives of Atmanirbhar Bharat.

(The author is a trainer for Civil Services aspirants.)